florida estate tax filing requirements

Use the Florida address when filing income tax returns. They would still be subject to income tax due on earned income even if it were paid directly to the trust.

Should I Put My Florida Homestead In A Living Trust

Florida Corporate Income Tax.

. Youll need several official death certificates throughout the probate process. Section 304 of the 2010 tax act also extended the sunset provisions for the federal estate tax through January 1 2013 provided in 901 of the 2001 tax act. Principal Law reminds you that the recipient of a gift is never liable for gift tax.

7336171 The fee is based on the value of the assets that go through probate plus any income they earn during the probate proceeding. The form must be filed in. Portfolio 50-6 III D.

39 See BNA Tax Mgt. For example if probate assets are 100000 legal fees. The Estate Tax is a tax on your right to transfer property at your death.

Florida sales tax rate is 6. Download Or Email Form DR-312 More Fillable Forms Register and Subscribe Now. Form 706 must generally be filed along with any tax due within nine months of the decedents date of death.

Florida estate tax due. If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

See also the comments on UTC. History of the Florida Estate Tax. Currently there is no estate tax in Florida.

You as the trustee must file the gift tax return Form 709 but only if you actually owe a gift tax. Florida 1099 Filing Requirements 2021 eFile Florida 1099-K directly to the Florida State agency with. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

The requirements for estates that file a Florida Estate Tax Return for Residents Nonresidents and Nonresident Aliens Form F-706 with no tax due have changed. However if the decedent owed Florida intangibles taxes for any year before the repeal of the intangibles. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is.

Representatives should order a minimum of 6. The state abolished its estate tax in 2004. If the following does not apply to you you are not required to file the return.

IRS Form 1041 US. Legal fees for a Formal Estate Administration must be reasonable but are typically three percent of the probate assets. Florida does not have a state income tax.

Read more on our site. December 31 2004 to. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

31 2004 must also file Florida estate tax returns. The decedent and their estate are. Up to 25 cash back Ann.

Residents who are required to file federal estate tax returns on the estates of decedents who died before Dec. For estates required to file. If the death occurs on or after January 1 2000 but before January 1 2005 the personal representative must comply with the two requirements listed above and.

Attach documentation of who you are drivers license or other ID. Prior to the change in 2004 federal law allowed a credit. Include the filing fee check with the county where you file for the fee amount.

Counties in Florida have the authority to levy an ad valorem tax on tangible personal property. Corporations that do business and earn income in. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the.

As a result of recent tax law changes only those who die in 2019 with. Common documents include. The requirements for estates that file a Florida Estate Tax Return for Residents Nonresidents and Nonresident Aliens Form F-706 with no tax due have changed.

There is no inheritance tax or estate tax in Florida. Ad Download Or Email DR-313 More Fillable Forms Register and Subscribe Now. The estate will not have any tax filing or payment obligations to the state of Florida.

No Florida estate tax is due for decedents who died on or after January 1 2005. We look forward to serving you. Give the Florida Probate Firm a call at 561 210-5500 to arrange a free consultation.

Florida 1099 State Reporting Requirements in full details. In terms of Florida residency requirements for tax purposes you will at minimum. The gift tax return is.

3 However not every estate needs to file Form 706. Florida tax is imposed only on those estates subject to federal estate tax filing requirements and entitled to a credit for state death taxes Chapter 198 FS. Obtain Florida tags on all vehicles.

Florida Probate Rules Processes What You Need To Know

Lexisnexis Automated Florida Probate Forms Lexisnexis Store

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Protect Your Property From Creditors And Reduce Your Property Taxes Using Florida S Homestead Exemption

Florida Homestead Exemption How It Works Kin Insurance

Should I Put My Florida Homestead In A Living Trust

Furthermore An Attorney Ensures That You Know About Any Judgements Relevant To The Property In All W Estate Planning Attorney Estate Planning Real Estate

Florida Property Tax H R Block

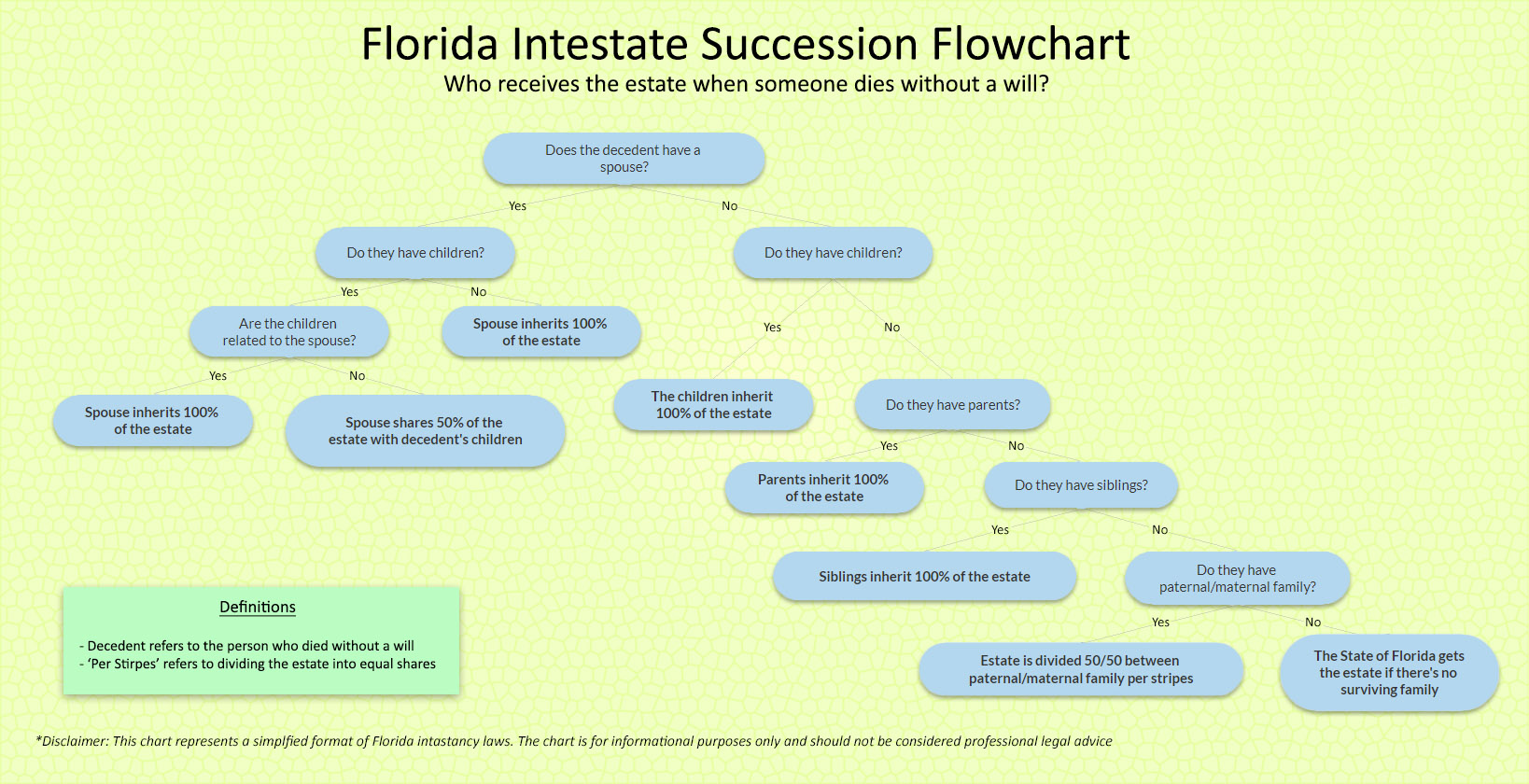

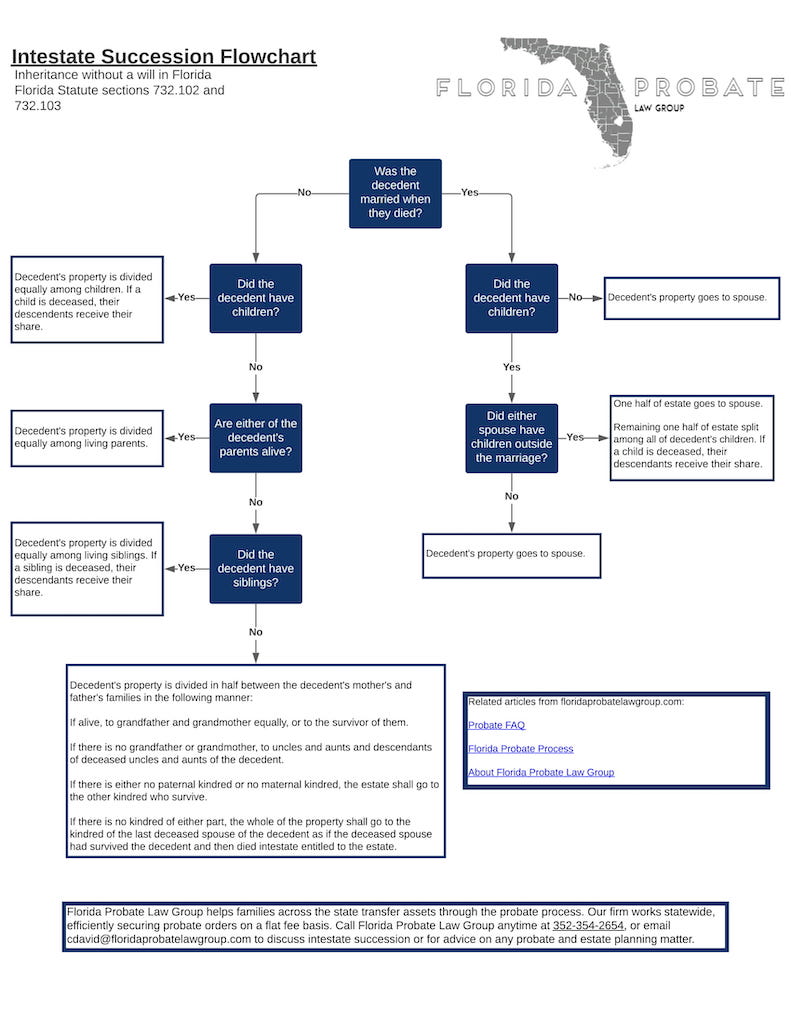

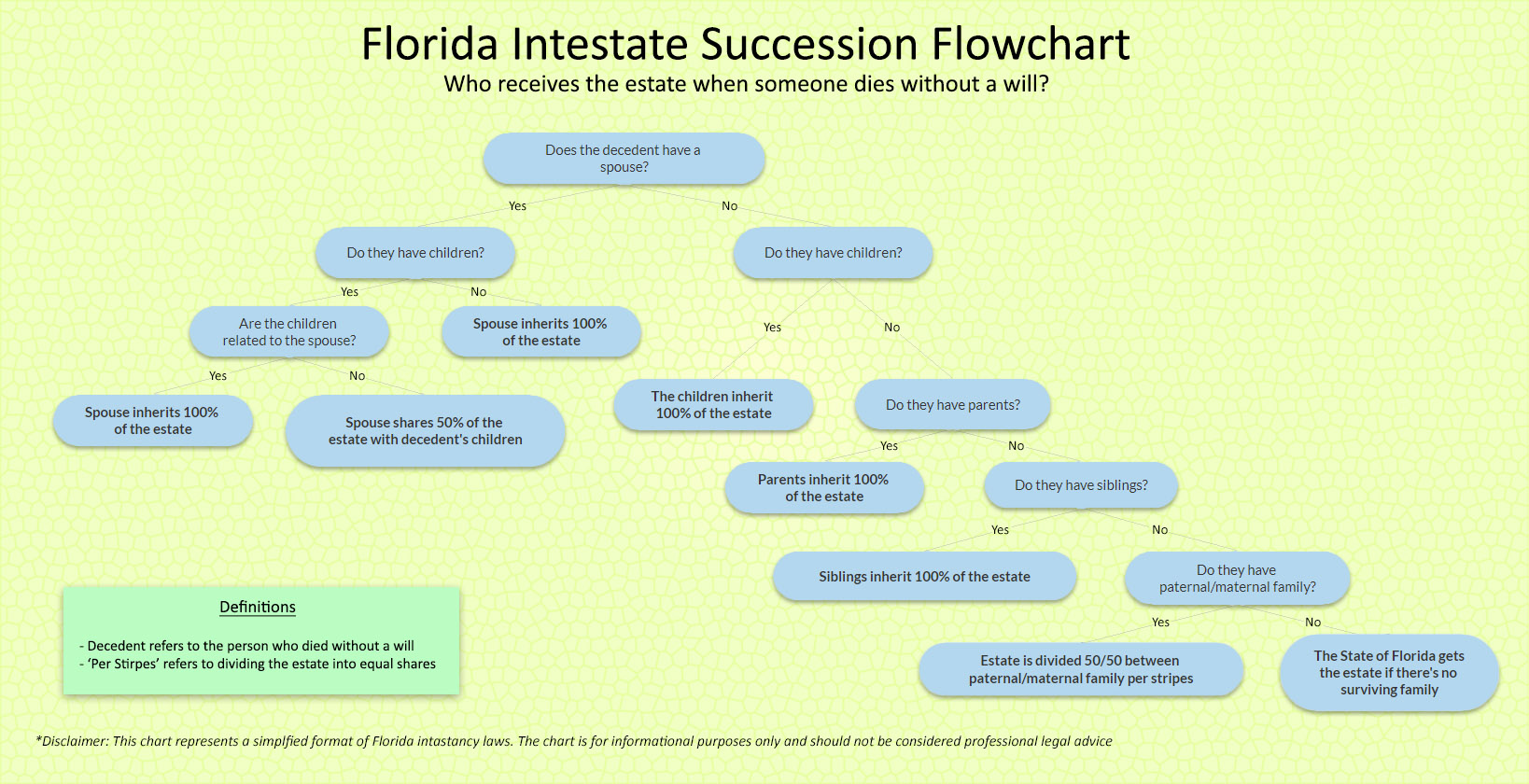

Intestate Succession In Florida Information On Probate

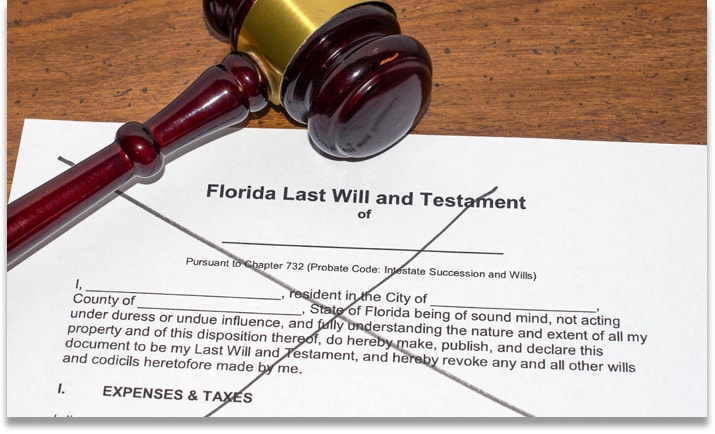

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

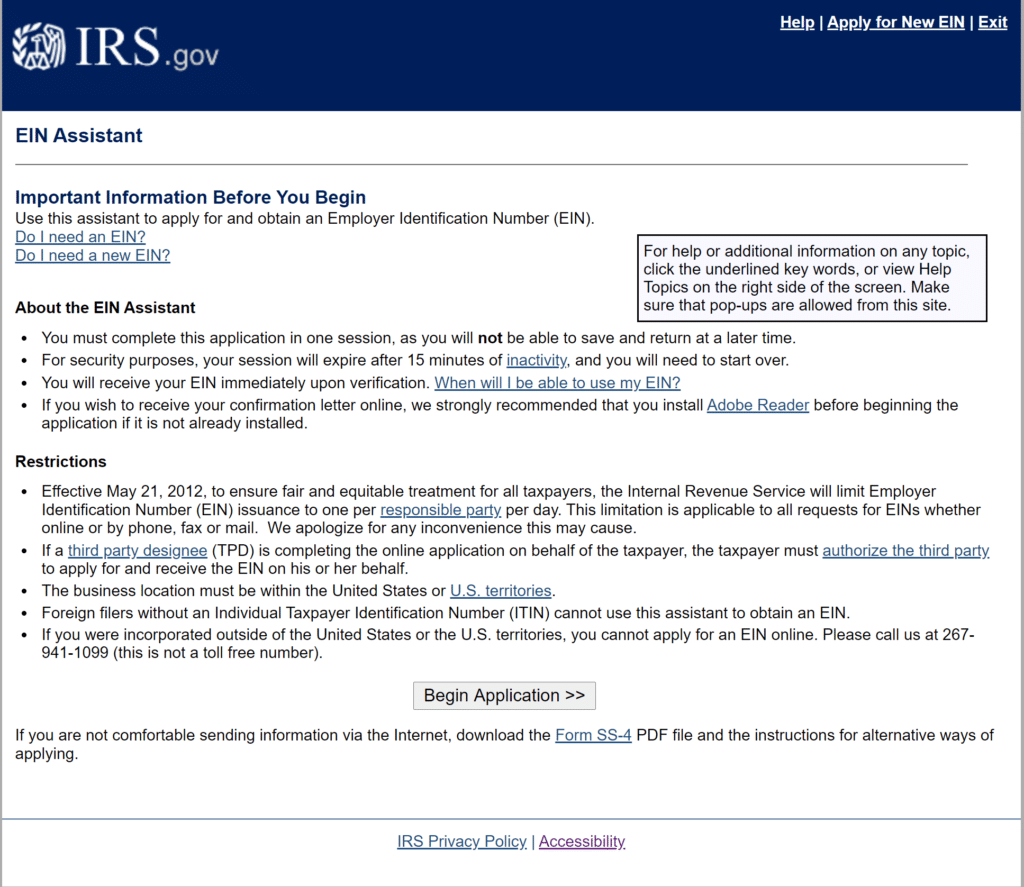

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Florida Probate Rules Processes What You Need To Know

What Is Florida County Tangible Personal Property Tax

Florida Tax Information H R Block

How Your Estate Is Taxed Or Not

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)